Building Your Financial Future with Kikoff: A Simple Guide to Credit Success

Struggling with a less-than-stellar credit score can feel like carrying a heavy backpack uphill. It’s tiring, frustrating, and slow-going. But what if I told you there’s a way to lighten that load? Enter Kikoff, your new financial pal that’s revolutionizing the credit-building game. Whether you’re a total newbie or you’re aiming to rebound from a credit mishap, Kikoff makes the journey smoother with its no-nonsense approach to boosting your credit.

No Stress Sign-Up: The Kikoff Way

Forget about the anxiety of credit checks that could ding your score even more. Kikoff flips the script by offering a sign-up process that’s as simple as signing up for a social media account. With no credit checks and a quick setup, you can get started in minutes. And the cherry on top? Users report seeing an average increase of 28 points in their credit score after just one month of using Kikoff. If you’re skeptical about the hype, there’s a 45-day money-back guarantee that lets you test the waters without any risk.

Kikoff’s Toolkit: Your Credit Score Gym

If building credit were a workout, Kikoff’s tools would be your personal training regime designed to bulk up your score effectively:

- Credit Account: This tool acts like a financial treadmill, helping you build stamina (aka credit history) without breaking a sweat. It’s designed to help you finance small purchases while building a solid payment history.

- Credit Builder Loan: Like weight training, this tool helps you build strength over time. You save money every month, which Kikoff holds onto. At the end of the year, you get it all back, plus the benefits of a boosted credit score.

- Secured Credit Card: This is your cardio—fast, effective, and essential. It works by letting you deposit a sum which then becomes your credit limit. Spend within your limits, pay back on time, and watch your credit health pulse stronger.

Credit Building with a Safety Net

One of Kikoff’s standout features is its commitment to safe credit building. The services are designed with guardrails, ensuring you don’t overextend yourself. This approach not only helps improve your credit score but does so without putting you at risk of falling into debt traps common with other credit-building methods.

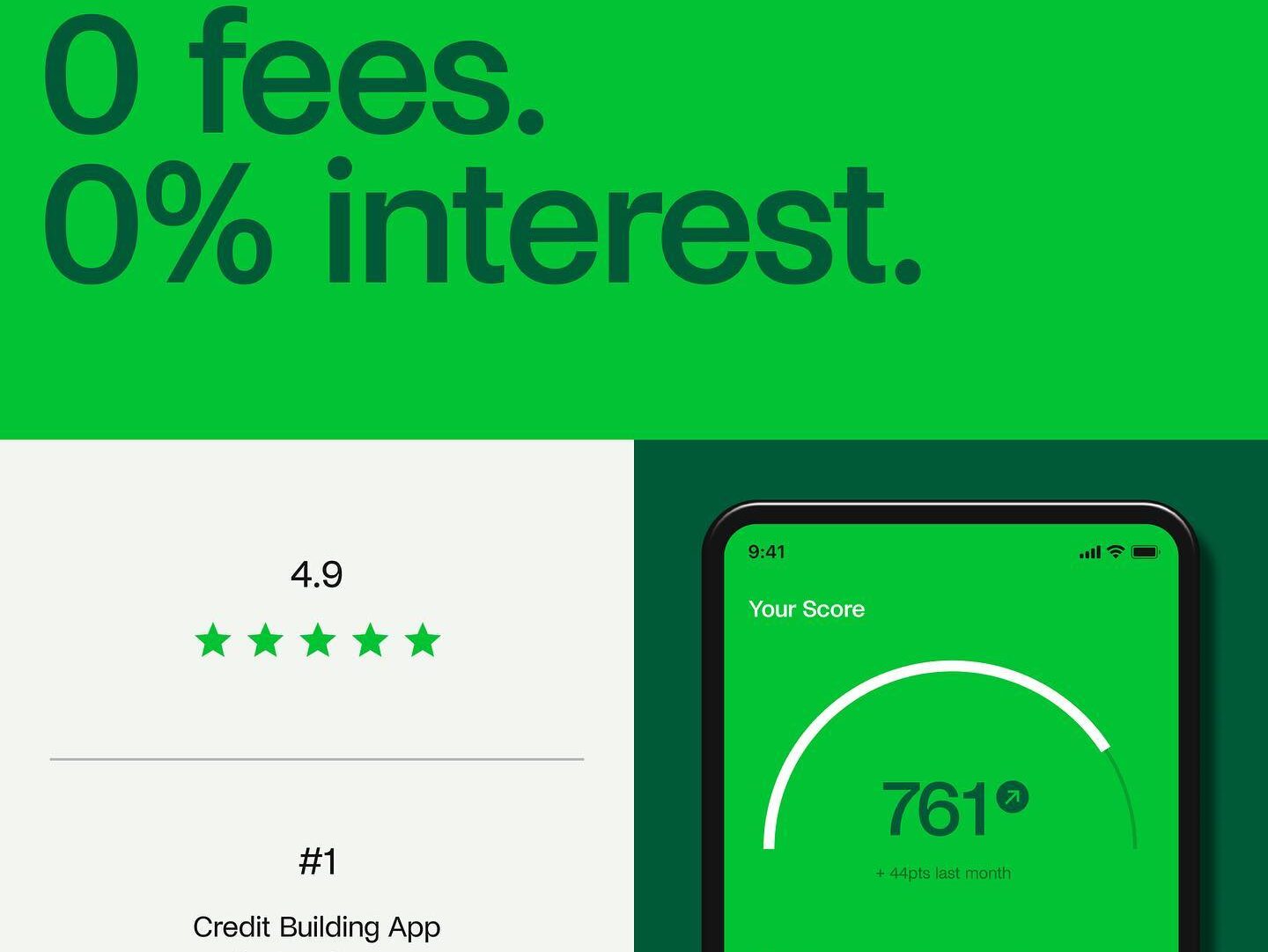

Tracking Your Success: Kikoff’s Credit Monitoring

Monitoring your credit is like getting regular health check-ups; it’s essential for maintaining your financial well-being. Kikoff offers comprehensive monitoring tools that keep you informed about every fluctuation and improvement in your credit score. It’s like having a dashboard that shows you the direct impact of your financial decisions, empowering you to stay on track.

Real Stories from Real People

Hearing from users who have walked the path can be incredibly motivating. Here are a few snippets from Kikoff users who have turned their financial lives around:

- Timothy L. went from being confused about credit to confidently managing his finances and improving his score before he even turned 20.

- Desiree F., a dedicated mother, used Kikoff to improve her family’s financial future, showcasing the profound impact good credit management can have.

- Nathan C., initially skeptical, now shares his success story with friends, having secured a car loan after his credit score soared.

Final Thoughts: Why Kikoff?

Choosing Kikoff isn’t just about improving a number; it’s about setting a foundation for future financial success. With its user-friendly interface, a suite of products that cater to various needs, and a community of users who’ve achieved tangible results, Kikoff stands out as a leader in credit building. It’s time to kick those credit worries to the curb and start on a path to financial freedom with Kikoff!

Ready to kick those credit woes to the curb? Give Kikoff a try and join the millions who’ve already taken steps towards a brighter financial future!