Financial Freedom with Borrowell: The Smart Way to Master Credit

In today’s fast-paced world, where financial decisions can have long-lasting effects on our lives, understanding and managing your credit score has never been more critical. Enter Borrowell, Canada’s pioneer in offering free credit scores and reports, providing over three million Canadians with the tools, tips, and personalized financial products they need to achieve their financial goals. This article dives into how Borrowell is transforming the financial landscape in Canada, making credit education accessible, and empowering individuals to take control of their finances.

Why Borrowell Is a Game-Changer in Financial Health

Borrowell’s mission goes beyond just providing free credit scores; it’s about fostering financial wellness across Canada. With bank-level security, weekly credit score updates, and personalized product recommendations, Borrowell offers a comprehensive approach to financial management that is both user-friendly and effective.

The Cornerstones of Borrowell’s Success

- Empowerment Through Education: Borrowell demystifies credit scores with easy-to-understand resources and personalized advice, enabling Canadians to make informed financial decisions.

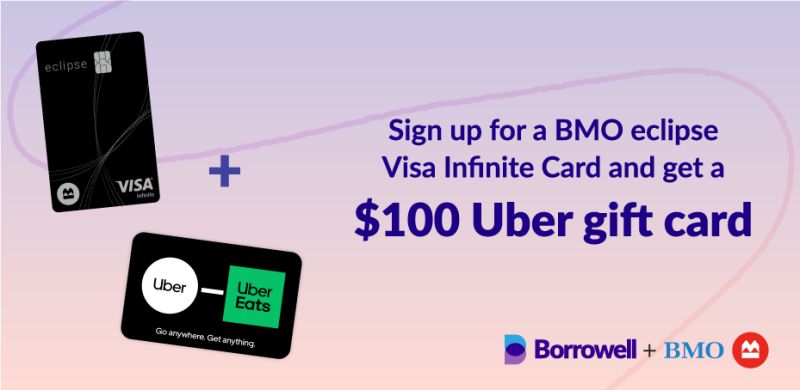

- Customized Financial Solutions: Whether you’re looking for loans, credit cards, or mortgages, Borrowell matches you with financial products that suit your credit profile, helping you to achieve your financial objectives.

- Innovative Financial Monitoring: With free weekly credit score updates and report monitoring, Borrowell keeps you informed about your financial health, offering peace of mind and the opportunity to act swiftly on any changes.

The Borrowell Advantage: Free and Fast Credit Insights

Borrowell’s standout feature is its commitment to providing fast, free, and easy access to your credit score and report. Unlike other services that require a credit card or bank information, Borrowell offers this service completely free, with no strings attached. This accessibility is a cornerstone of Borrowell’s philosophy, ensuring that every Canadian has the knowledge and tools to improve their financial health.

Beyond Scores: A Comprehensive Financial Ecosystem

Borrowell’s ecosystem extends beyond credit scores, encompassing a wide range of financial products and services designed to cater to your unique financial situation. From securing a loan to choosing the right credit card, Borrowell’s personalized recommendations serve as a roadmap to better financial health.

Real Stories, Real Success

The impact of Borrowell’s services is best seen in the stories of its users, from individuals who have improved their credit scores and gained access to better financial products, to those who have used Borrowell’s insights to navigate their way out of debt. These success stories underscore the transformative power of having the right tools and knowledge at your disposal.

Navigating Your Financial Journey with Borrowell

Whether you’re looking to improve your credit score, explore new financial products, or simply gain a better understanding of your financial situation, Borrowell offers a tailored experience that meets you where you are.

With Borrowell, you’re not just a number; you’re part of a community that’s invested in your financial success.